By WANG Tingting

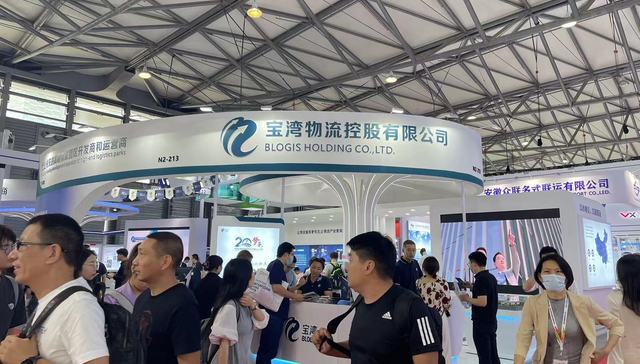

After a hiatus of three years, Transport Logistic China 2023 was held in Shanghai from June 14 – 16. Around 700 exhibitors brought new technologies, products and solutions. While the residential real estate industry remains under strict regulatory control, logistics real estate continues to thrive.

The exhibition covered eight themes, including air freight, cold chain logistics, and road/rail transportation. Among them, logistics real estate (warehouse parks) was the focus of the event.

As the largest cold chain logistics real estate developer in China, VX Logistics is optimistic. The company has 48 warehouses dedicated to cold chain logistics and aims for an increase of 1.5 million square meters this year.

VX Logistic Chairman ZHANG Xu believes that cold-chain logistics in China is just beginning to develop. For example, the pre-cooling rate for all agricultural products is only 30 percent in China, while it has reached 90 percent in Europe. The cold chain circulation rate in China is only 40 percent, compared to 90 percent in Japan.

Zhang said: "Whether the economy is doing well or not, people's pursuit of a better life remains unchanged. This is a business that constantly innovates and rejuvenates."

This consensus is shared by the industry. In addition to traditional warehouses, cold chain and pharmaceutical logistics have become strong growth areas. Compared to traditional warehouses, cold storage offers more revenue streams, though construction costs are approximately twice that of dry warehouses. Demand remains uncertain but the initial investment is substantial. Mature regulation is also absent, creating a different kind of risk.

ZHANG Yu, director of global customer solutions and business development at Prologis China, shared his experiences in the pharmaceutical logistics field. Pharmaceutical logistics necessitate a collaborative ecosystem involving multiple parties. Efficient collaboration means sharing resources, information, equipment, and services. A network of warehouses can shorten drug logistics routes and time, helping pharmaceutical companies reduce costs.

While the competition in the logistics real estate industry is fierce, not all regions are suitable for further expansion. Several real estate developers said that the Yangtze River Delta and the Greater Bay Area show relatively good performances, with the Chengdu-Chongqing region also being viable. The Yangtze River Delta and the Greater Bay Area will inevitably witness another round of competition.

However, within the context of the national economy, certain industries are facing challenges. To ensure high occupancy rates, many real estate developers have cut rents and land acquisition has become more challenging. As a result, they have been buying up second-hand land and actively taking over properties from distressed real estate companies. This is pressure for companies seeking rapid expansion. VX Logistics has the goal of going public within three years. "There's no other way; we can only aggressively acquire other assets," Zhang said.

Nevertheless, as a highly market-driven industry, warehousing and logistics present a competitive landscape.

"Compared to other industries, logistics real estate, photovoltaics, and new energy are doing relatively well at present," said an investor searching for business opportunities at the event.