by LIU Sunan

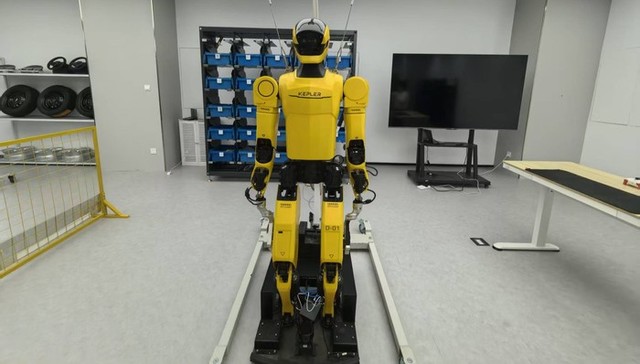

Inside a modest office in Shanghai's Zhangjiang technology hub, a 1.75-metre-tall humanoid robot in bright yellow stands quietly on display. Nicknamed "Bumblebee", it is the flagship product of Kepler Robotics, a start-up founded in 2023, betting that China's humanoid robot makers still have a narrow window to turn prototypes into factory workers before global heavyweights fully arrive.

The robot, officially known as K2, has already secured several thousand indicative orders worth hundreds of millions of yuan, according to LIU Aiheng, Kepler's global business director. Mass production began in September and deliveries are now under way, he said in an interview with Jiemian News.

Weighing 75 kilograms, K2 can lift up to 30 kilograms with its two arms and run for about eight hours on a one-hour charge. Kepler estimates that industrial customers could recoup their investment within 1.5 to 1.8 years, underscoring its focus on factory use rather than futuristic demonstrations.

Kepler's push comes as 2025 is increasingly described by industry executives as the first real year of humanoid robot mass production. Tesla has launched a pilot production line for its Optimus robot and is targeting large-scale manufacturing in 2026. In China, AgiBot said earlier this month that its 5,000th humanoid robot had rolled off a Shanghai assembly line, while UBTech has begun delivering its Walker S2 industrial models, underscoring the industry’s shift from prototypes to cost, reliability and real-world use.

Despite its short history, Kepler is open about benchmarking itself against Tesla's Optimus, widely regarded as the global reference model.

The challenge for Chinese start-ups is whether they can establish meaningful technical and application barriers before Tesla scales up production and reshapes the competitive landscape.

Like Optimus, Kepler's first deployments are aimed at automotive manufacturing. Liu said the company's robots are being tested in factories and logistics facilities, with applications expected to expand gradually as reliability improves.

Behind the scenes, Kepler has pursued a high degree of vertical integration. About 80 per cent of K2's core components, including harmonic motors, dexterous hands and planetary roller screws, are developed in-house. The screws, often described as a robot's "artificial muscles", convert rotary motion into linear movement and account for roughly 20 per cent of the robot's total cost.

The company has also drawn investors from across China's industrial supply chain, including listed firms specializing in precision components, sensors, CNC machine tools and servo systems. The ties provide both supply-chain support and access to real-world testing environments.

Hardware maturity remains the biggest obstacle to large-scale commercialization, said ZHU Binbin, Kepler's senior product manager. Planetary roller screws offer high efficiency and load capacity, but ensuring stability and durability under continuous industrial use requires long periods of testing, he said. Each K2 uses 14 such screws, with energy conversion efficiency exceeding 80 per cent, well above that of conventional rotary joints. Tesla has adopted a similar technical route in Optimus.

Dexterous hands pose another challenge. Rather than pursuing extreme human-like dexterity, Kepler has opted for modular, task-specific designs that can be swapped depending on the job. "In industrial settings, the optimal solution doesn't necessarily look like a human hand," Zhu said.

Beyond hardware reliability, intelligence is proving even harder to crack. Ideally, a humanoid robot would be able to enter a factory and learn workflows within days. In practice, extensive pre-deployment training and algorithm tuning are still required.

Kepler is training its robots using a "vision-language-action" model to handle perception, planning and grasping tasks. Even so, Zhu estimates that large-scale deployment of humanoid robots on production lines is still three to five years away.

For now, the race is less about spectacle than timing. The question facing companies like Kepler is not whether humanoid robots will eventually enter factories, but how much room Chinese start-ups have before global giants such as Tesla set the pace.