by YANG Zhijin

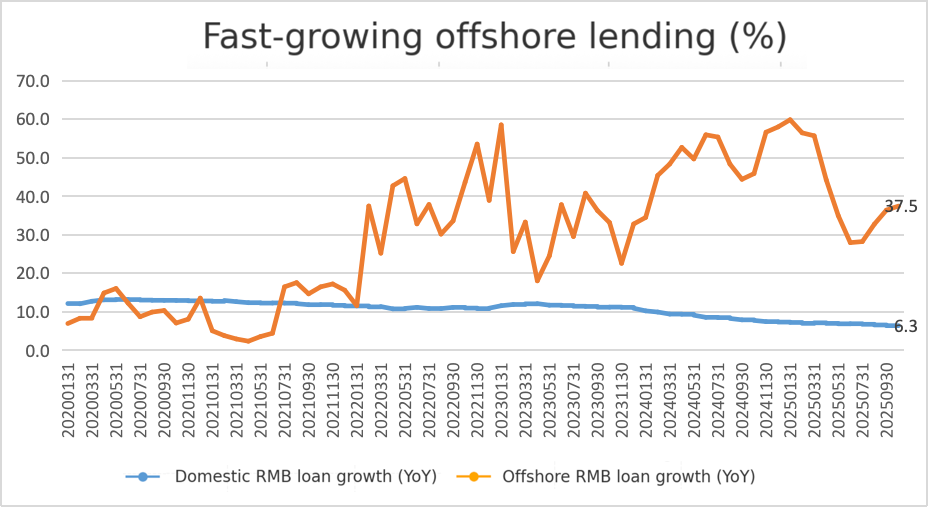

China's credit cycle is increasingly being reshaped offshore, with renminbi loans extended outside the mainland growing several times faster than domestic lending and pointing to a deeper structural shift in how Chinese banks deploy capital abroad.

Data from the People's Bank of China (PBOC) show offshore RMB loans reached RMB 2.5 trillion at end-October, up 37.5% from a year earlier and maintaining double-digit growth for a fourth consecutive year. The offshore segment accounted for 3.1% of all new loans in the first ten months, more than double its share in 2021.

Bankers and analysts say the trend reflects a combination of weak domestic credit demand, a widening interest-rate gap between China and major developed economies, and an acceleration in Chinese companies' outbound investment—factors reinforced by a more assertive policy push to internationalize the renminbi.

Rate differentials pull borrowers toward RMB

The PBOC has cut policy rates repeatedly over the past two years as inflation stayed subdued, pushing Chinese yields to historic lows and sharply widening spreads with the United States and Europe. Ten-year Chinese government bond yields are near 1.8%, compared with 4.1% in the U.S. and 2.7% in the euro area.

"The current onshore–offshore rate gap has changed borrowing incentives," said WANG Qing, chief macro analyst at Golden Credit Rating. "Offshore entities find RMB funding significantly cheaper than dollar or euro borrowing, and banks facing soft domestic demand are reallocating balance-sheet resources abroad."

The differential has prompted some developing economies, including Kenya, Angola and Ethiopia, to shift parts of their U.S.-dollar liabilities into RMB to reduce servicing costs, according to state media.

Offshore RMB credit remains small relative to domestic lending—just under 1% of the total—but has grown from about RMB 700 billion at end-2021 as Chinese rates fell and Western rates stayed elevated.

Banks follow Chinese firms abroad

Another driver is a renewed wave of Chinese outbound investment as manufacturers diversify supply chains under "China+1" strategies and seek to mitigate tariff risks in Western markets. Many companies are adding capacity in Southeast Asia, the Middle East and Africa and require financing from lenders familiar with their business models.

China's outbound direct investment is expected to approach US$200 billion in 2024, about 45% above 2019 levels, according to Ministry of Commerce data.

"Domestic and offshore financial services are still segmented, and many firms rely on separate providers in each market," said GUO Kai, executive director at the China Finance 40 Forum. He said large Chinese banks need to extend their service chains across borders, a shift that in his view will require greater regulatory flexibility and business innovation.

The seven largest state-owned lenders—including ICBC, CCB, ABC, Bank of China, China Development Bank, BoCom and Postal Savings Bank—hold roughly half of all offshore RMB loans. Joint-stock banks and some foreign lenders have also expanded their RMB business as corporate clients build more overseas operations.

Policy momentum accelerates RMB internationalization

Regulators have actively encouraged the shift. A 2022 policy move allowing banks to lend directly to offshore companies—rather than only to Chinese firms' overseas projects—marked a turning point, analysts said. Since then, offshore RMB lending has grown far faster than total cross-border loans in all currencies.

Foreign-currency lending offshore, especially in U.S. dollars, has grown more slowly and still accounts for more than half of all offshore credit, limiting the increase in headline cross-border loan growth.

Beijing's 15th Five-Year Plan proposals call for deeper renminbi internationalization, enhanced cross-border payment infrastructure and broader capital-account openness. The PBOC has repeatedly stressed the need to strengthen the RMB's financing function, signaling that cross-border lending and RMB-denominated bond issuance are policy priorities.

"Policy signals are clear: the authorities want a larger RMB presence in global funding markets," Wang said. "Offshore RMB credit growth is responding directly."

Outlook: structural shift or rate-cycle anomaly?

Bank executives expect offshore RMB lending to maintain strong momentum even if growth moderates. One senior executive at a large state-owned bank said annual increases in the "20–30% range" are likely, citing persistent rate differentials and continued outbound expansion by Chinese firms.

For now, offshore lending is giving banks a new source of growth at a time when domestic credit demand is subdued, while gradually expanding the renminbi's footprint in cross-border financing.