by JIA Lu

Editor's note: To provide timely and comprehensive insights into China's electric passenger vehicle exports, Jiemian Intelligence of Jiemian News and SINOIMEX launched the monthly China Electric Passenger Vehicle Export Report in March 2025. The report tracks changes in export value, volume and destination markets to support decision-making for governments, companies and investors.

China's electric passenger vehicle industry continued its global ascent in August, powered by a mix of competitive pricing, manufacturing upgrades, and expanded overseas capacity. Export volumes jumped 83% year on year to 358,900 units, while export value surged 58% to US$6.52 billion — both hitting new monthly highs. The sector is moving beyond simply shipping cars overseas, evolving toward a multi-dimensional strategy of "globalized manufacturing, streamlined logistics, extended industrial chains, and precision marketing."

Export momentum accelerates

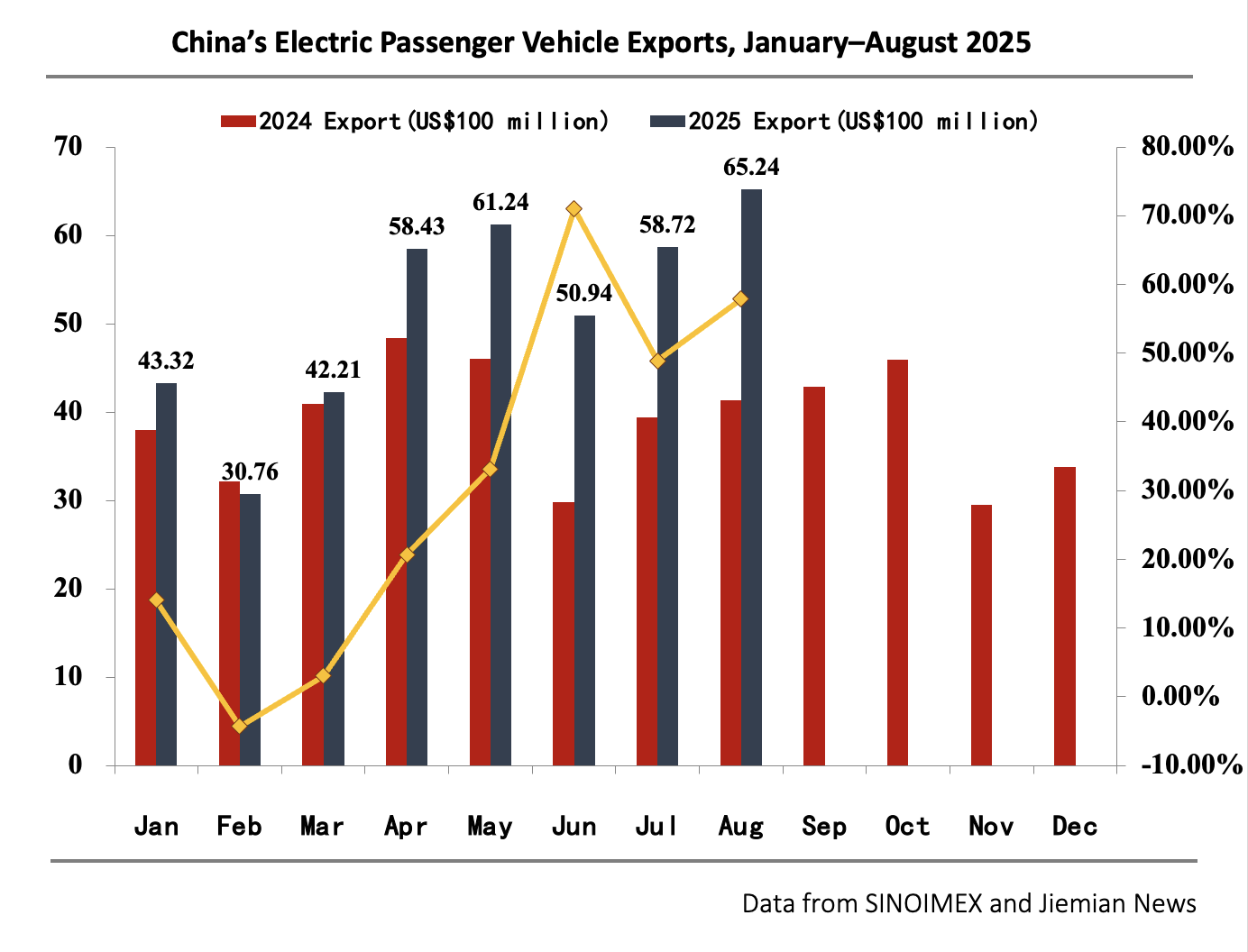

Between January and August, China's total trade in electric passenger vehicles reached US.53 billion, up 22% from a year earlier. Exports accounted for nearly 95% of that total, with cumulative shipments climbing 53% to 2.26 million units. August alone contributed significantly to this momentum, with both volume and value increasing sequentially by over 10%.

The average export price stood at US$18,179 per vehicle, down 14% from a year earlier as automakers deepened "price-for-volume" strategies to gain market share. Still, the slight month-on-month rise of 0.6% suggested pricing is stabilizing after several months of declines.

Passenger cars made up over 99% of all electric vehicle exports in August, accounting for US$6.24 billion in value. Among them, pure electric and plug-in hybrid models led the surge. Prices of plug-in hybrids fell the most — by 26% year on year to an average US$20,466 — while pure electric models averaged US$16,674, down nearly 15%.

In contrast, electric buses showed a "volume and price increase" trend, with exports up 4% year on year to 1,394 units and export value up 37% to US$286 million. The average price rose more than 30%, reflecting rising demand for high-value large vehicles and technology upgrades in overseas public transport markets.

Regional reshuffle: Shanghai, Jiangsu and Anhui lead

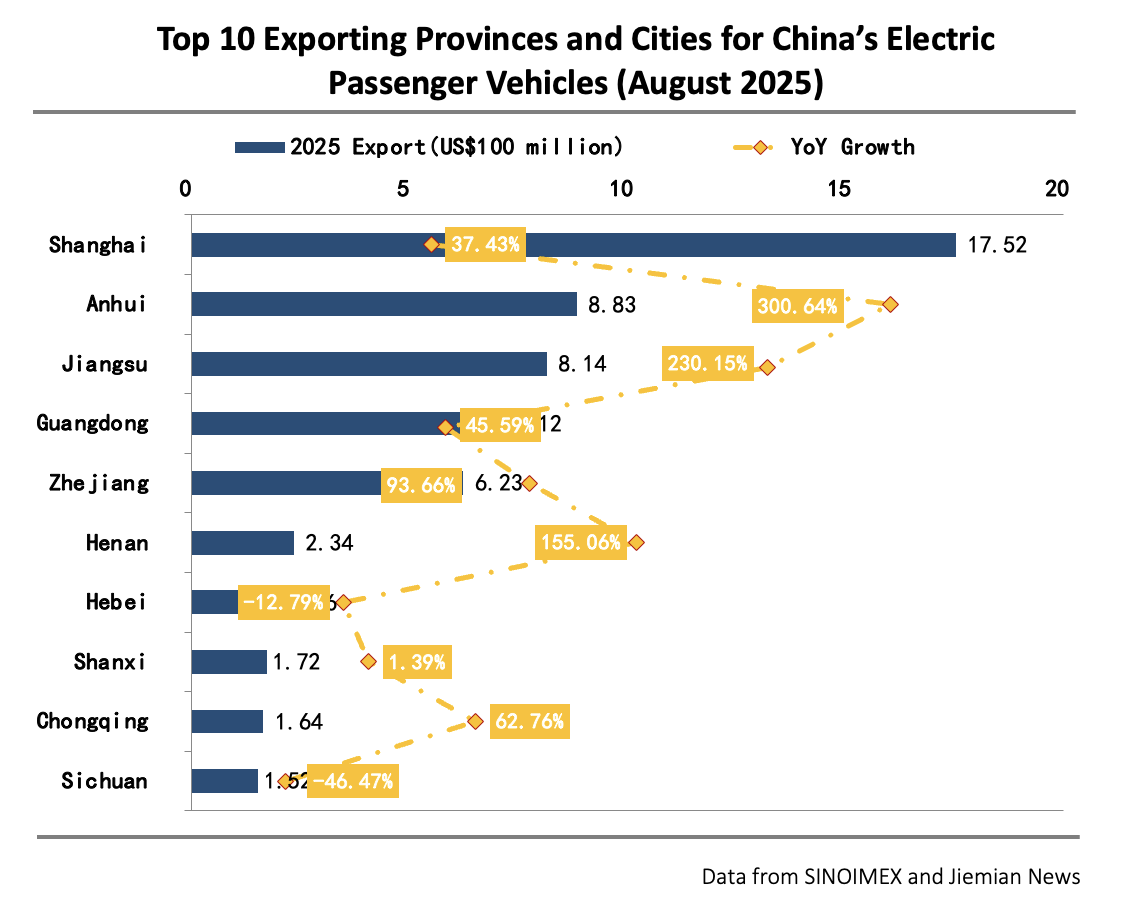

Shanghai remained China's largest EV export hub in the first eight months, shipping vehicles worth US$9.02 billion, followed by Jiangsu (US$5.32 billion, up 136%) and Guangdong (US$3.99 billion, up 16%). Together, the top ten provinces accounted for nearly 86% of total national exports.

August saw a reshuffle among top-performing regions. Shanghai (US$1.75 billion) retained the lead, while Jiangsu and Anhui were also among the top-five. Hunan fell out of the top ten, replaced by Sichuan. The report noted widening disparities among provinces, with ten regions recording export growth above 100% while nine registered declines.

Markets diversify as emerging economies surge

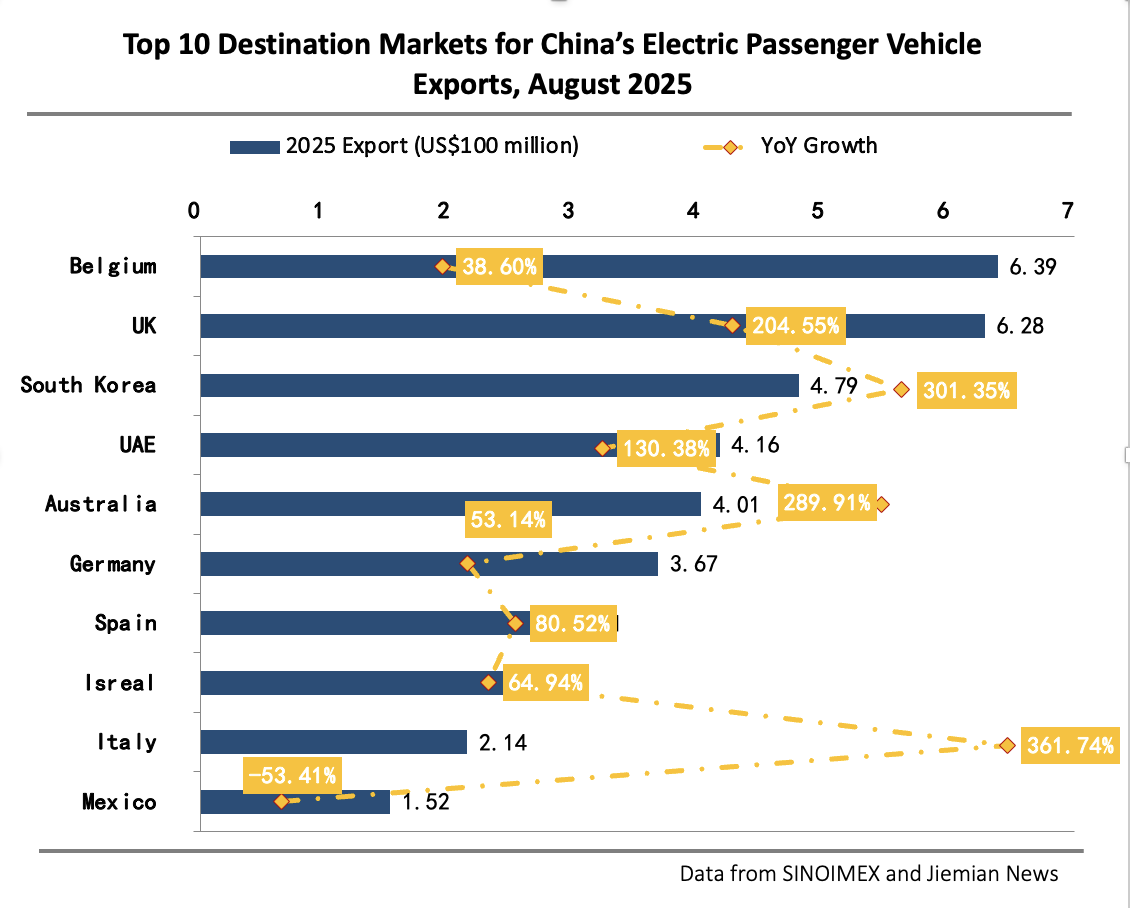

China's EV exports now span 165 countries and regions, underscoring both the breadth and speed of its global expansion. Belgium remained the top destination from January to August, with imports worth US$4.5 billion, followed by the United Kingdom (US$3.9 billion) and the United Arab Emirates (US$2.5 billion). The top ten destinations together accounted for 56% of total exports.

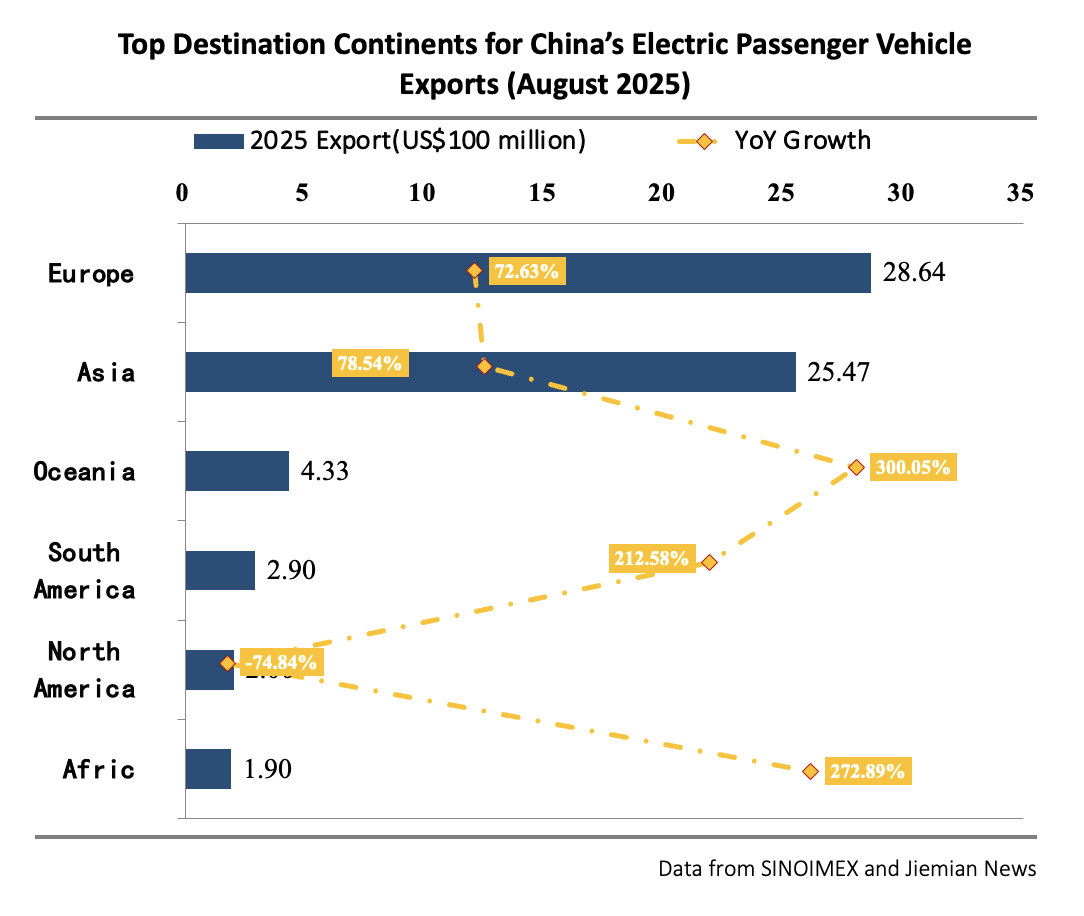

Emerging markets are quickly becoming growth engines. Africa's EV imports from China soared 273% year on year in August, while exports to Oceania surged 300% — the highest growth among all continents. South America and Asia also recorded triple-digit gains.

Europe also maintained steady growth, with exports reaching US$2.86 billion, up 73% year on year, highlighting China's growing competitiveness in mature markets. However, China's export landscape is shifting from dependence on Europe toward a more balanced global footprint, as Southeast Asia, the Middle East, and Africa gain importance.

Global manufacturing and logistics take center stage

Chinese automakers are accelerating overseas localization and logistics upgrades to sustain growth.

BYD's plant in Thailand reached a milestone in August, shipping over 900 electric cars to Europe for the first time — including to the UK, Germany and Belgium — marking its Southeast Asia base's evolution into a global export hub.

Great Wall Motors launched production at its new Brazilian facility in mid-August, initially with a 30,000-unit annual capacity and plans to expand to 50,000 by 2028. The plant's early models include hybrid and ethanol-compatible versions of the Haval H6.

Leapmotor, meanwhile, confirmed that its European manufacturing base will be in Zaragoza, Spain, using Stellantis Group's industrial resources. Production of its B10 and B05 models is set to begin in the third quarter of 2026.

At the same time, China's logistics and trade environment improved. A 90-day mutual tariff suspension between China and the U.S. — announced after the Stockholm economic dialogue in August — partially reduced cross-border costs.

On August 8, Leapmotor and Italy's Grimaldi Group launched the Grande Tianjin roll-on/roll-off ship to Europe, capable of carrying 2,500 vehicles per voyage. The collaboration marks growing sophistication in China's dedicated EV shipping solutions.

From products to ecosystems

China's EV sector is exporting more than vehicles — it is exporting an industrial ecosystem. Leapmotor's subsidiary Zhejiang Lingxiao Energy has begun supplying self-developed battery packs to over five new-energy commercial vehicle clients, sourcing cells from CATL and other major suppliers. Chery Automobile is expanding technical cooperation with partners in Pakistan and Saudi Arabia and plans to distribute its Omoda and Jaecoo brands in Iraq later this year.

In terms of industrial collaboration and technology export, Chinese automakers are accelerating the global construction of their industrial ecosystems, diversifying from vehicle manufacturing into core component supply. Companies are also making notable advances in niche market and regional deployment, reflecting the increasing pace of industrial coordination and technology export. These developments highlight China's transformation from vehicle assembly to comprehensive ecosystem building — encompassing design, battery innovation, component supply, and regional adaptation.

Other firms are targeting niche markets: Zeekr entered Australia in August with its Zeekr 7X high-end model, priced at AU$57,900 (about 271,000 yuan), while JAC Motors launched three electric commercial models in Indonesia to fill a local market gap.

August marked a transition from "volume growth" to "ecosystem expansion." With localized production, reduced trade costs and upstream diversification, Chinese automakers are building global competitiveness at a faster pace.

China's EV industry is moving from exporting cars to exporting capacity, technology and supply chains. This is not only reshaping global competition, but also defining the next stage of China's industrial globalization.