JIA Lu

Editor's note: To provide timely and comprehensive insights into China's electric passenger vehicle exports, Jiemian Intelligence of Jiemian News and SINOIMEX launched the monthly China Electric Passenger Vehicle Export Report in March 2025. The report tracks changes in export value, volume and destination markets to support decision-making for governments, companies and investors.

China's electric passenger vehicle exports eased slightly in September after hitting a record high in August, but maintained strong year-on-year momentum as shipments to emerging markets surged and carmakers accelerated plans for localised production to navigate diverging global trade policies.

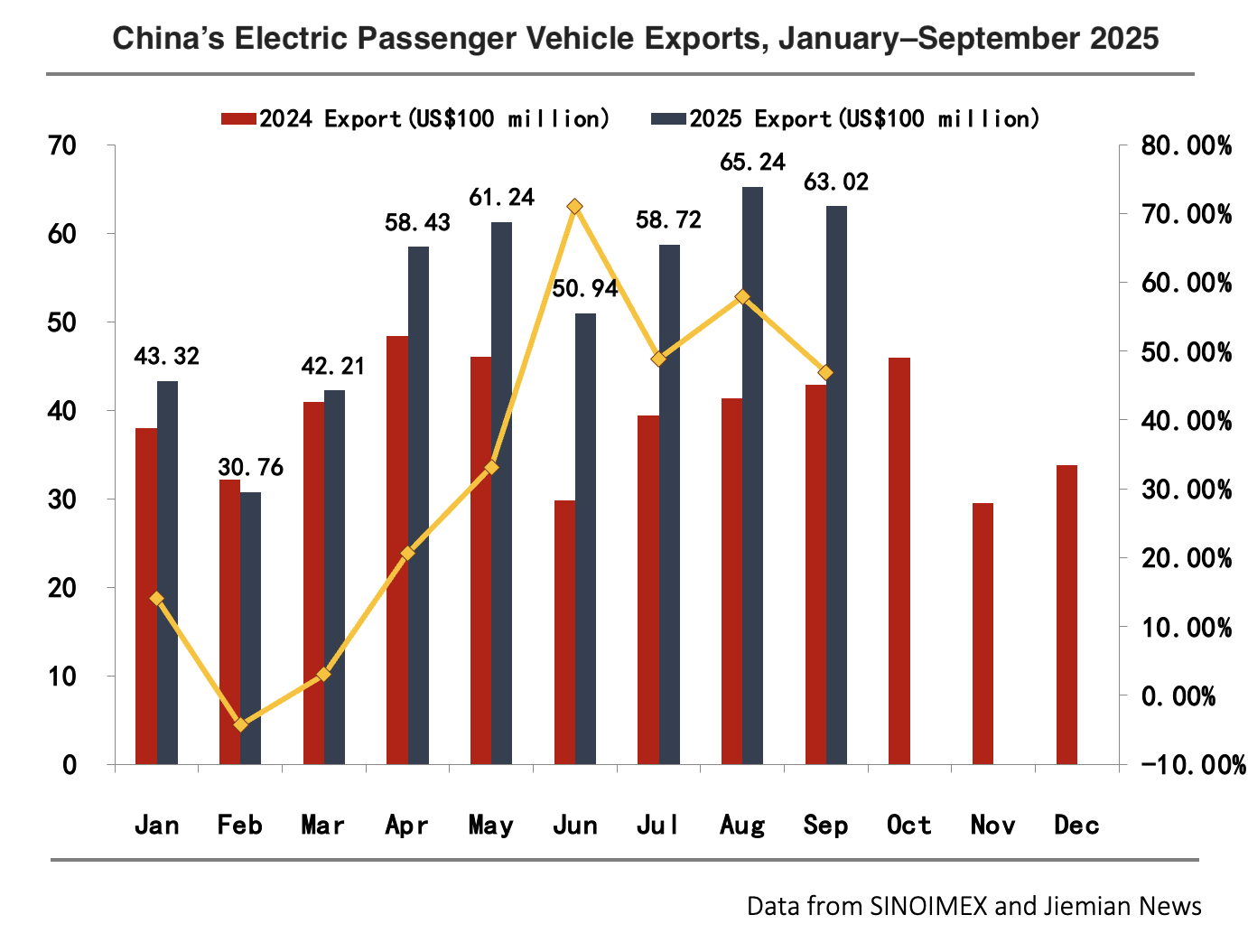

According to data compiled by Jiemian News and SINOIMEX, China exported US$47.39 billion worth of electric passenger vehicles in the first nine months of 2025, an increase of 32 per cent from a year earlier. Export volumes reached 2.6 million units over the same period, up 55.15 per cent and extending the acceleration recorded in August, underscoring resilient global demand for Chinese-made EVs.

Exports in September totalled US.3 billion, rising 46.91 per cent year on year but falling 10.9 percentage points from August's elevated level. The average export price stood at US,251, around 13 per cent lower than a year ago, suggesting that the "price-for-volume" strategy employed by many carmakers earlier this year is gradually stabilising.

Passenger cars remained the core of China's EV exports, accounting for more than 99 per cent of the total volume and 95 per cent of export value. Shipments of electric passenger cars reached 343,900 units in September, a 69.40 per cent increase from a year earlier, while the average export price fell to US$17,426, down 13.74 per cent. Plug-in hybrids showed the sharpest price decline, falling nearly 28 per cent year on year, which helped Chinese brands gain traction in price-sensitive overseas markets.

The bus segment outperformed the broader market. Bus exports climbed to 1,335 units in September, up 25.59 per cent year on year, while export value surged 64.40 per cent to US$308 million. The average export price rose by almost one-third to US$230,000, driven almost entirely by demand for pure electric buses, which accounted for more than 99 per cent of shipments. Hybrid buses, by contrast, saw both volume and prices plunge, reflecting diverging technology pathways in the commercial EV sector.

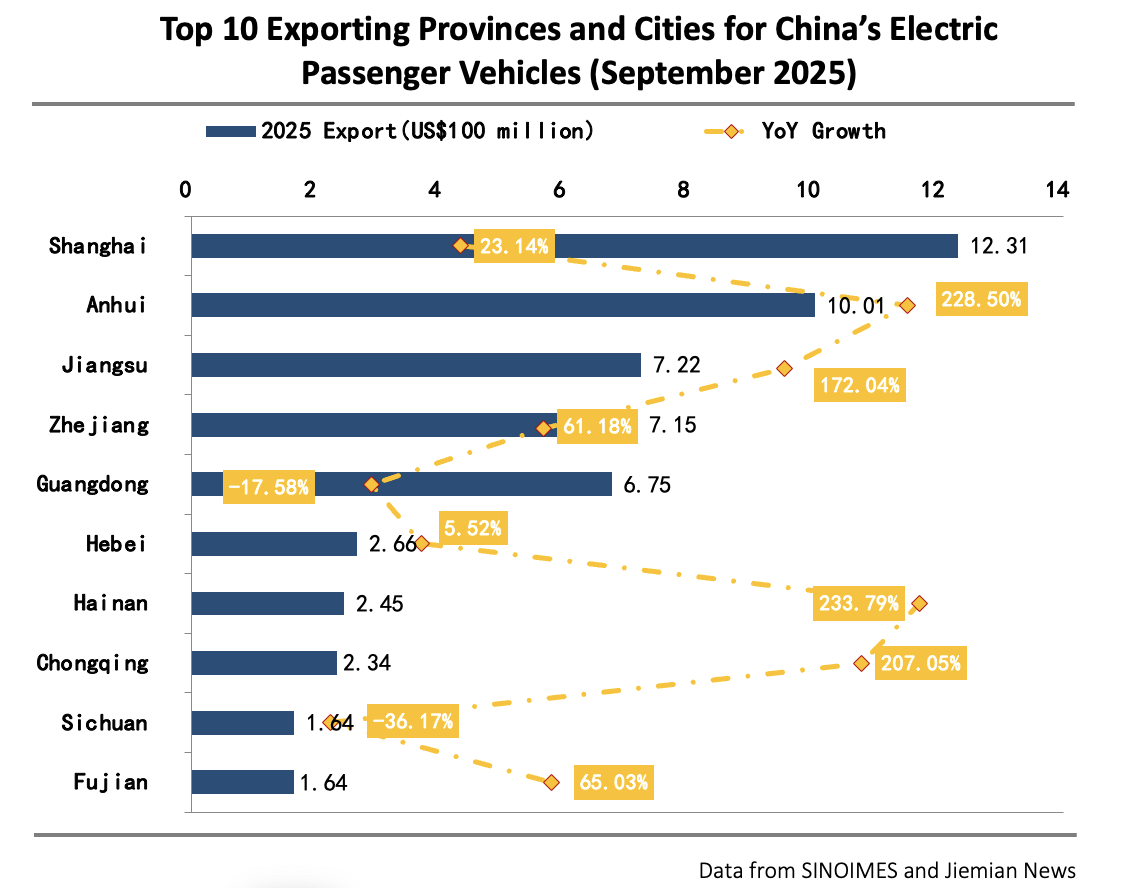

Regional performance: Shanghai, Jiangsu and Anhui lead while growth diverges

Shanghai, Jiangsu and Anhui continued to lead the country's EV export landscape in the first nine months of the year, with combined shipments that accounted for the bulk of China's total. Shanghai remained the largest export hub with US$10.25 billion in shipments, though the figure was marginally lower than a year earlier. Jiangsu and Anhui posted sharp increases, rising 139.83 per cent and 255.96 per cent respectively, as local manufacturing clusters scaled up their export capacity. The top 10 provinces and municipalities together contributed more than 85 per cent of China's EV export value, highlighting the increasingly concentrated geography of the industry.

Regional growth, however, showed sharper divergence in September, with Guizhou, Gansu, Jiangxi, Henan and Hunan recording the fastest year-on-year increases, while Sichuan, Liaoning, Hubei, Guangdong and Inner Mongolia posted the weakest growth. Nationwide, 11 provinces saw export growth exceed 100 per cent in September and six registered declines — a pattern driven largely by base effects and differing levels of export capacity rather than shifts in competitiveness.

Export destinations: Mature markets steady, emerging markets accelerate

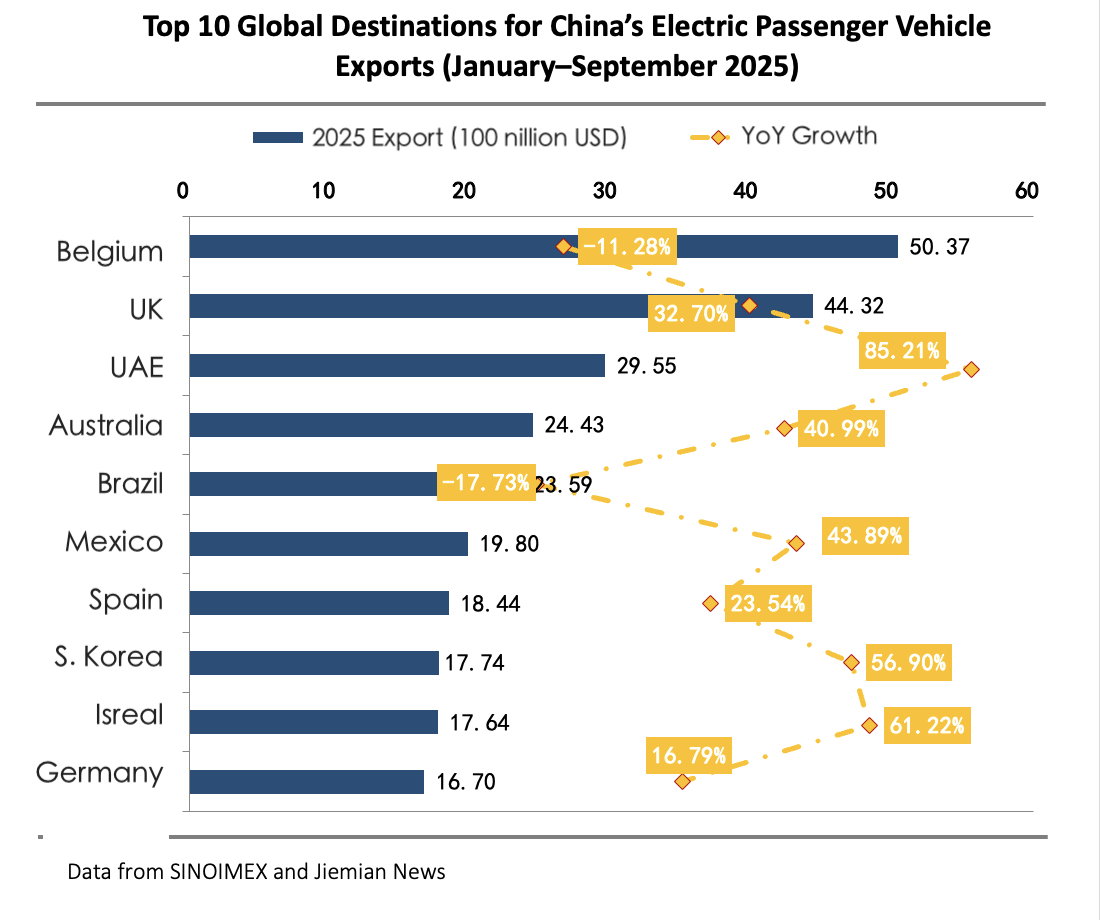

On the demand side, China's top export destinations remained largely unchanged. Belgium, the United Kingdom and the United Arab Emirates continued to rank as the three largest markets, together absorbing more than half of China's electric passenger vehicle exports from January to September. Belgium remained the top destination despite an 11.28 per cent decline, while the UK and the UAE recorded strong growth of 32.70 per cent and 85.21 per cent respectively.

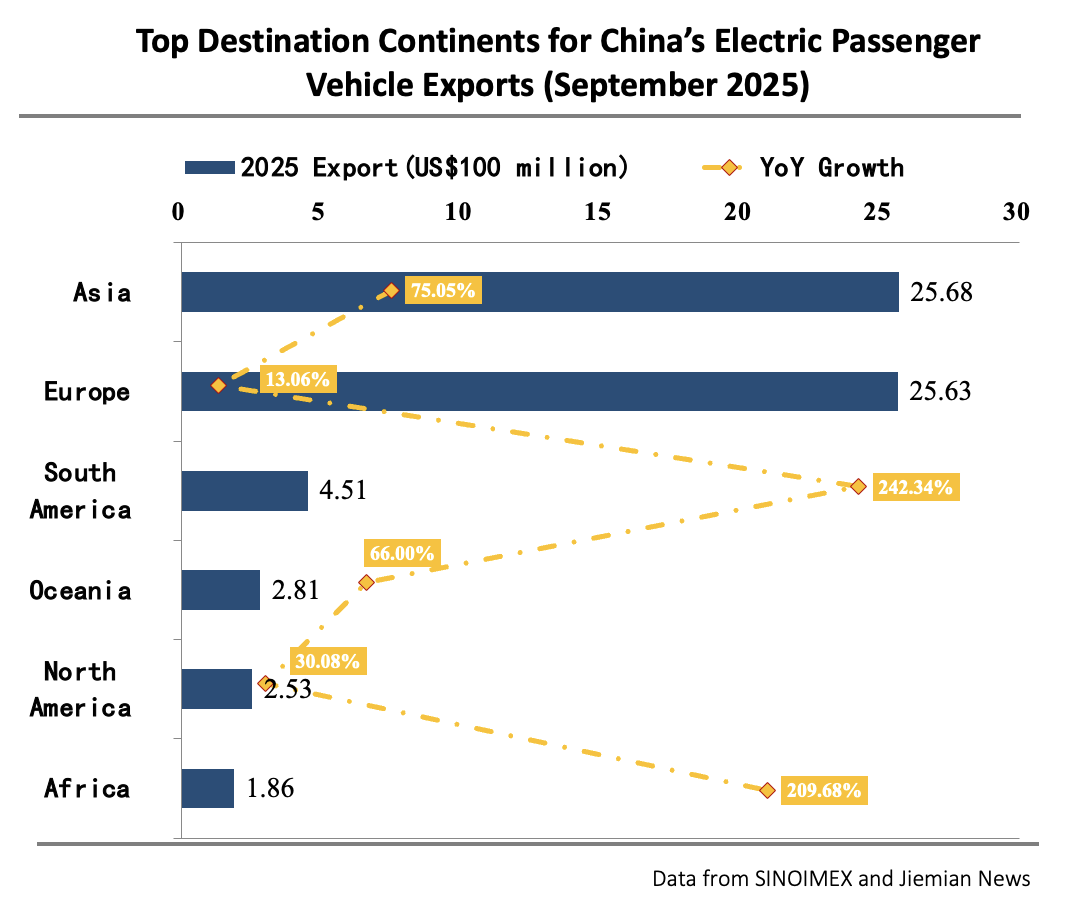

September shipments covered 142 countries and regions—slightly fewer than in August but still reflecting extensive market reach. Asia remained China's largest regional market by coverage, with exports rising 75.05 per cent to US$2.57 billion. Europe maintained steady growth despite slower expansion compared with emerging markets, with shipments increasing 13.06 per cent to US$2.56 billion, signalling continued acceptance of Chinese EVs in mature automotive markets.

The most striking performance came from developing regions. Exports to Africa surged 209.68 per cent in September, while shipments to South America soared 242.34 per cent, the fastest increase among all continents. The rapid acceleration in these two markets suggests that local consumers are entering a phase of more active EV adoption, supported by China's cost advantages and vehicle models tailored for varying infrastructure conditions.

Localisation and policy shifts reshape global strategies

Against this backdrop, Chinese carmakers have stepped up efforts to localise production to reduce tariff exposure and strengthen supply chain resilience. Geely launched its first Proton brand EV factory in Malaysia in early September, with an initial capacity of 20,000 units and plans to expand output to 45,000 units.

BAIC Foton brought its Uganda assembly plant online, reinforcing its position in East Africa's growing commercial vehicle market.

In Europe, Xpeng is preparing to begin localised production of its G6 and G9 models at Magna's plant in Austria by the third quarter of 2025, while BYD is pushing ahead with new plants in Hungary and Turkey as part of its plan to achieve full European local production within three years.

GAC, meanwhile, signed an agreement to build a US$19 million KD plant in Cambodia that is expected to begin mass production in 2026.

Trade policies are also prompting carmakers to adjust strategies. The United States raised tariffs on Chinese-made electric vehicles to 100 per cent, a move that effectively shuts out most Chinese imports in the short term. However, new autonomous-driving regulations expected in 2026 could create space for technology-focused collaborations.

South America is emerging as a new battleground, with Leapmotor set to begin sales in Brazil and Chile through an initial network of 36 dealerships. Mexico's decision to raise tariffs on Asian vehicles to 50 per cent, and Indonesia's plan to remove EV tariff exemptions by the end of 2025, are pushing Chinese automakers to accelerate local production footprints in these markets.

At the same time, technology exports are becoming a more prominent part of China's global EV expansion. Nio has begun supplying technologies to McLaren, strengthening its overseas service revenue, while SAIC acquired a stake in eVTOL developer Volant as it expands into integrated "ground and air" mobility solutions. Xpeng opened its first European R&D centre in Munich to support algorithm localisation, and battery makers including CATL are accelerating construction of European factories to underpin localised EV production.

Despite the more complex external environment, China's electric passenger vehicle industry continued to advance its global footprint in September. Emerging markets are providing powerful new growth engines, while Europe and other mature markets are showing signs of steady consolidation.

Rapid progress in local manufacturing and rising technological influence are giving Chinese carmakers stronger buffers against trade barriers, positioning the industry to meet full-year export targets and deepen its role in the global EV supply chain.