by ZHU Yongling, HUANG Shan

In August, Swiss premium outdoor brand Mammut opened its first showcase store in southwest China at Chengdu's U-Fun mall. On the same floor sits Arc'teryx, while domestic rival Kailas has also set up nearby.

The scene illustrates how a once-niche segment has expanded into a crowded arena, with Chinese brands filling every price point and overseas players such as Norway's Norrøna, America’s Woolrich and Sweden’s Klättermusen also seeking a foothold.

China's outdoor boom began about five years ago, and no brand rode the wave harder than Arc'teryx. But with Kailas rapidly closing the gap in gross merchandise value and a swarm of smaller challengers chipping away, the Canadian label's period of runaway growth appears to be over. The market itself is also settling into maturity.

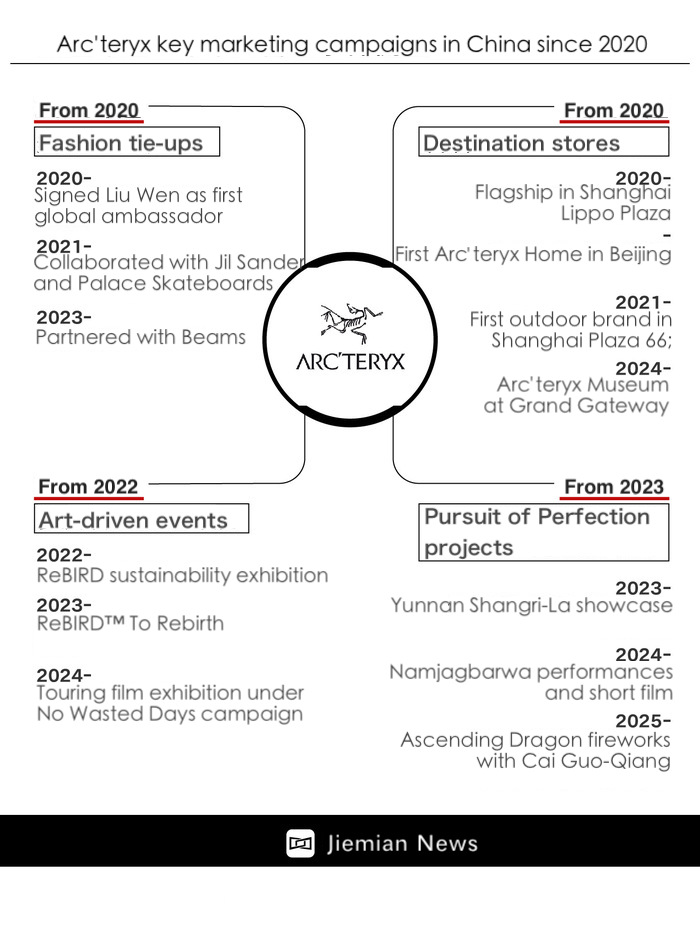

Arc'teryx has stood out in China not just for its technical gear but also for high-profile campaigns that combine outdoor culture with artistic expression. These attention-grabbing efforts have kept the brand in the spotlight, but they have also carried risks. Its "Ascending Dragon" fireworks show with artist Cai Guo-Qiang on September 19 drew sharp online backlash, highlighting the dangers of relying too much on pageantry in a more sophisticated market.

The controversy, widely criticized as tone-deaf and excessive, tapped into broader unease about Arc'teryx's trajectory. Once celebrated purely for performance, the brand has leaned heavily into luxury-style positioning, raising prices, staging theatrical events and expanding into high-end malls.

For a while, the approach paid off. Global revenue nearly doubled between 2020 and 2022 to US$952 million, making Arc'teryx the main growth engine for Anta-controlled Amer Sports. Its technical apparel unit, which also includes Peak Performance, doubled again from 2022 to 2024, while Amer's share price more than doubled after listing in early 2024.

Yet the fireworks backlash underscored a crucial truth: in a maturing market, pageantry or high-profile marketing alone may no longer be enough.

The luxury turn

After Anta acquired Amer Sports in 2019, Arc'teryx named XU Yang, a veteran of 4A advertising agencies, as Greater China general manager. Xu repositioned the brand as "sporting luxury." The team he assembled included executives from both international and domestic sports labels, with many key roles in sales, marketing and communications filled by professionals with backgrounds in luxury and fashion.

Over the next six years, Arc'teryx staged shows on a 3,300-meter plateau in Shangri-La, mounted art performances at Mount Namjagbarwa, and opened museum-style and Alpha concept stores in Shanghai and Chengdu. It also broke with outdoor retail convention by moving into luxury malls such as Plaza 66 in Shanghai and WF Central in Beijing, and introduced one-to-one sales consultations that often left shoppers queuing outside.

Industry insiders told Jiemian News that Arc'teryx was one of the few sports labels to invest in elaborate window displays, refreshed regularly at high cost. Products also shifted toward fashion, with collaborations from Jil Sander+ in 2021 to Japanese streetwear brand BEAMS in 2022. In China, hardshell jackets sold for 7,000 yuan to more than 10,000 yuan, setting new price benchmarks for the sector.

Industry insiders told Jiemian News that Arc'teryx was one of the few sports labels to invest in elaborate window displays, refreshed regularly at high cost. Products also shifted toward fashion, with collaborations from Jil Sander+ in 2021 to Japanese streetwear brand BEAMS in 2022. In China, hardshell jackets sold for 7,000 yuan to more than 10,000 yuan, setting new price benchmarks for the sector.

Framed more broadly, the luxury turn was innovative for an outdoor brand, helping Arc'teryx elevate its positioning and push pricing boundaries in China. The approach successfully expanded its reach beyond climbers and outdoor professionals into the wardrobes of high-net-worth and middle-class urbanites, though it also created unintended consequences.

A double-edged image

At the height of Arc'teryx's hype in China, even tags once fetched hundreds of yuan on resale platforms, while scalpers lined up outside stores for limited releases. Suddenly, people who had never entered a store were shaping the brand's social image.

On Chinese social media, Arc'teryx has been mocked as part of the "three treasures of middle-aged men," alongside Moutai liquor and fishing gear. Critics argue that many new buyers have little interest in the outdoors or sustainability, purchasing instead for status. "Mountaineering jackets have become commuter or banquet wear," one viral post read.

Luxury-style practices also drew fire. Queue-inducing consultations were widely ridiculed as arrogance, and some outdoor enthusiasts felt the approach strayed too far from the brand's professional roots.

Industry observers note that Arc'teryx's early success with its luxury-style playbook created a form of path dependence. For a period, the company in China did not clearly recognize which consumer groups were driving attention, discussion and actual purchases.

Slowing momentum, rising rivals

Meanwhile, growth has cooled. Amer's Greater China revenue surged 84% in fiscal 2021 but slowed to 54% by 2024. Domestic rivals such as Kailas are catching up, combining professional credibility with community-driven campaigns. At July's ISPO Shanghai expo, 634 brands from 30 countries showcased gear from canyoning to cycling, underscoring the crowded field.

Arc'teryx has set a bold target: 20 billion yuan in China sales from 100 stores by 2030, averaging 200 million yuan per location. By late 2023 it had 63 outlets, with some already reaching that figure, according to people familiar with operations.

To sustain such performance will require more than pageantry or high-profile marketing. Arc'teryx must keep affluent urbanites engaged while holding onto its core outdoor athletes. Without credibility among climbers and professionals, the brand risks losing the foundation that made it desirable in the first place.

Looking for a reset

Signs of change are emerging. In 2023, Nike and The North Face veteran YAO Jian replaced Xu Yang. This year, Amer named MA Lei and SHE Yifeng, both with sportswear backgrounds, to head its China operations.

High-profile marketing campaigns continue, but more resources are now going into professional credibility. Arc'teryx launched a "World-Class Crag Project" in China in 2024, while its long-running "Mountain Classroom," founded in 2012, has been expanded in China to include beginner courses.

These efforts, however, remain limited when measured against the brand's scale and the initiatives of its rivals. Kailas sponsors major trail and climbing events, runs charity programs and hosts frequent community activities such as its "Rock Solid" program, which brings outdoor experiences to urban residents.

Outdoor enthusiasts told Jiemian News that try-on events and training camps play a major role in shaping loyalty. For Arc'teryx, scaling up such touchpoints could be decisive. The challenges it now faces may also push Arc'teryx to accelerate a return to professional roots and reassess whether its strategies of recent years can sustain growth in the new stage.

Lessons from the skies

A cautionary tale comes from beyond outdoor gear. In 2023, Cathay Pacific faced a storm after a mainland passenger was denied a blanket for not asking in English, sparking national outrage. Rather than dismissing it as a one-off, the airline launched systemic reforms, from language training to localized catering and marketing. It has since rebounded faster than peers.

For Arc'teryx, the fireworks backlash carries a similar warning. Rebuilding trust will require more than apologies. It will demand genuine resolve and concrete steps to reconnect with both core athletes and broader consumers.

As China's outdoor market matures, Arc'teryx can no longer rely on attention-grabbing campaigns to stay ahead. Its future may hinge on rediscovering what set it apart in the first place: technical performance, authenticity and the sporting spirit that truly inspires.