by ZHU Yongling

U.S. casualwear brand Hush Puppies, acquired last year by Beijing Jiaman Dress, is relaunching in China with a themed flagship opening in Shanghai this month.

The new Hopson One flagship adopts a "home" theme to create a warm, welcoming setting and features adult apparel from the 2025 fall/winter line with a dedicated footwear section.

Jiaman, a top mid- to high-end childrenswear operator, said the flagship marks Hush Puppies' shift to a lifestyle brand. After gaining full control of adult apparel in mid-2024, it has expanded products and stores and worked to rebuild the brand, positioning adult wear as its core in China.

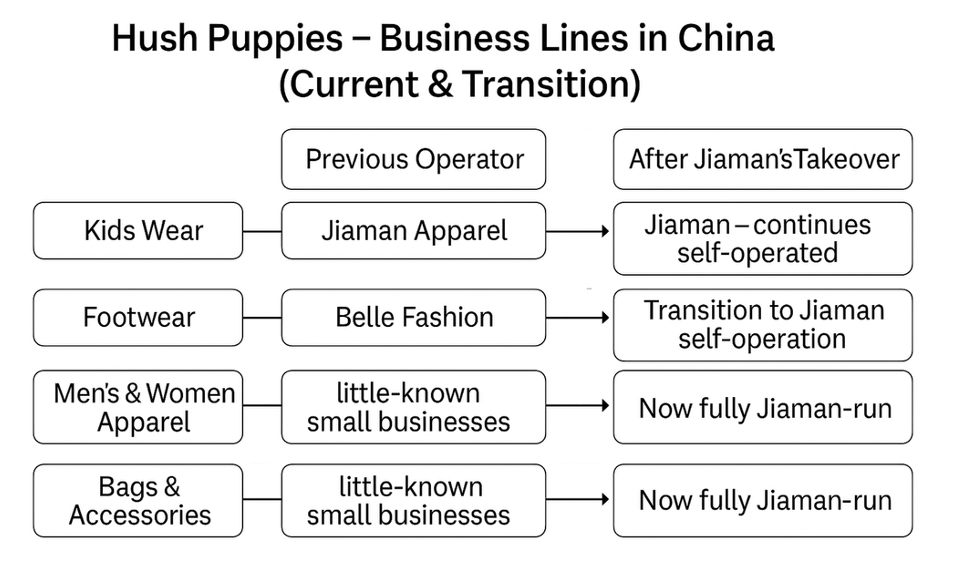

Hush Puppies long depended on local licensing - a common strategy for U.S. apparel brands in China - but, unlike Ralph Lauren and other premium U.S. labels thriving amid "quiet luxury" trends, it has struggled with a fragmented image. Before Jiaman's takeover, its apparel, footwear, childrenswear and luggage were split among four operators, including Belle Fashion for shoes and Jiaman for kids wear. In early 2024 Jiaman bought the brand's mainland and Hong Kong/Macau IP for about 430 million yuan (about US$60 million) and then gradually reclaimed licensing rights for adult apparel and footwear to bring those lines in-house.

Jiaman is expanding beyond its childrenswear roots into self-owned adult brands aimed at middle- to high-income consumers in top-tier cities, benchmarking Aigle, Ralph Lauren and Hazzys.

As part of this strategy, it is revamping Hush Puppies - founded in 1958 and known for its relaxed American style - updating adult products, channels and marketing while preserving the brand's signature look. In China, Hush Puppies items sell mostly for 500-2,000 yuan (about US$70-280), with some up to 4,000, and analysts see growth potential given the label's low profile and Jiaman's strength in premium kids wear.

Challenges remain. Jiaman has little experience in adult fashion or footwear, having relied on its regionally focused kids wear brand Shuihai'er. After Belle's Hush Puppies shoe license expired, it rebranded those stores as Mirabo, a rival targeting the same shoppers and growing online. Jiaman is preparing its own footwear line, shifting online channels and planning in-store shoe sales.

Independent analyst Cheng Weixiong of Shanghai-based Liangqi Brand Management said Jiaman is seeking new growth after 2020–24 annual revenue stayed around 1–1.2 billion yuan (about US $140–170 million)and annual profit at 100–200 million (about US$14-28 million). He cautioned that breaking into China's crowded mid-to high-end adult market will require heavy brand investment and at least two to three years to pay off. First-half 2025 revenue rose 3.5%, while selling expenses jumped 28% on higher store and marketing costs.