By PANG Yu

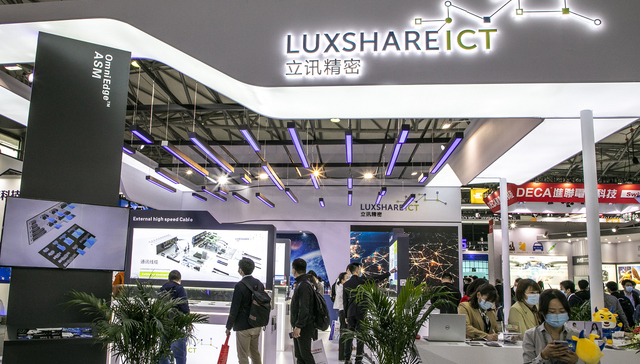

Last week’s visit by Apple CEO Tim Cook to Luxshare Precision, an electronic components supplier in Zhejiang Province, attracted its fair share of international headlines, underlining the fact that over 95 percent of Apple’s products are manufactured and assembled in China.

Before the visit, Luxshare boss WANG Laichun revealed that the company will make Apple’s Vision Pro, a mixed-reality headset to be launched next year.

In the first three quarters, Luxshare made 156 billion yuan (US$21 billion) in revenue with 7.4 billion yuan attributable to the parent company, up by 7.3 and 15.2 percent respectively. It’s not as good as it looks: This is the first time in nearly a decade that revenue growth has fallen into single digits.

Luxshare Precision’s fate is intertwined with that of Apple with 73.3 percent sales in 2022 going to Apple. It’s bad news all around that the iPhone 15 has failed to make much impression on the Chinese market. The sluggish consumer electronics market means that the gross margin in this sector has declined for three years.

Luxshare Precision is eagerly looking out for new drivers. The EV industry has emerged as a promising sector that could provide the company with a new engine.

In the first half of 2023, the auto parts business of Luxshare expanded at an unprecedented speed, though it still represents a small share of the total revenue.